inheritance tax waiver form nc

All groups and messages. The inheritance tax of another state may come into play for those living in North Carolina who inherit money.

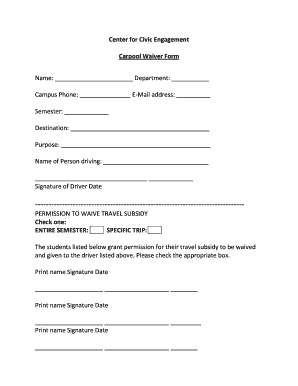

Carpool Waiver Form Fill Online Printable Fillable Blank Pdffiller

Ad The Leading Online Publisher of National and State-specific Legal Documents.

. Art firearms historic memorabilia and other collectibles may be subject to certain taxes. REV-1381 -- StocksBonds Inventory. Ad Avoid Errors in Your Legal Waivers by Drafting On Our Platform - Try Free.

Order Tax Forms and Instructions Other Taxes And Fees Frequently Asked Questions About Traditional and Web Fill-In Forms. That means that tax is paid when the holder of an IRA account or the beneficiary takes distributionsin the case of an inherited IRA. REV-714 -- Register of Wills Monthly Report.

For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212. North Carolina Inheritance Tax and Gift Tax. IRAs and inherited IRAs are tax-deferred accounts.

The federal gift tax has an annual exemption of 16000 per recipient. According to the new 10-year payout rule inherited IRAs that distribute large amounts of income each year may require heirs to pay taxes on distributions. Please DO NOT file for decedents with dates of death in 2016.

A legal document is drawn and signed by the heir waiving rights to. US Legal Forms eliminates the lost time countless American citizens spend surfing around the internet for perfect tax and legal forms. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

Our skilled crew of attorneys is constantly upgrading the state-specific Forms catalogue to ensure that it always has the right files for your. Pennsylvania Inheritance Tax Safe Deposit Boxes. A married couple can gift away up to 32000 to.

Each California resident may gift a certain amount of property in a given tax year tax-free. 28A-21-2a1 is not required for a decedent who died on or after 112013. North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms.

REV-1197 -- Schedule AU -- Agricultural Use Exemptions. Avoid Errors In Your Legal Liability Waiver. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax.

All groups and messages. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the state. Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax.

An inheritance or estate waiver releases an heir from the right to claim assets in the event of another persons death. STATE OF NORTH CAROLINA County NOTE. Over 1M Forms Created - Try Free.

Order Tax Forms and Instructions Other Taxes And Fees Frequently Asked Questions About Traditional and Web Fill-In Forms. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Waivers Form 0-1 can only be issued by the Inheritance Tax Branch of the NJ Division of TaxationIt is not a form you can obtain online or fill out yourself. Individual income tax refund inquiries. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island.

An estate tax certification under GS. Sample Letter Of Disclaimer Of Inheritance Related Forms. Nj Inheritance Waiver Tax Form 01 Pdf Fill Online Printable Fillable Blank Pdffiller States With An Inheritance Tax Recently Updated For 2020.

Individual income tax refund inquiries. Form 0-1 is a waiver that. Download Or Email L-8 More Fillable Forms Register and Subscribe Now.

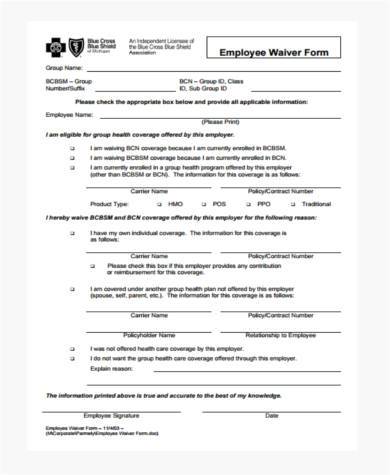

Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1 2013. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. Federal estate tax could apply as well.

Contact Us If you have additional questions about the North Carolina inheritance tax contact an experienced Greensboro probate attorney at The Law Offices of Cheryl David. In most circumstances some kind of return or form must be filed with the Division in order to have a. PO Box 25000 Raleigh NC 27640-0640.

A legal document is drawn and signed by the heir that forgoes the legal rights of the items. There is no inheritance tax in North Carolina. How does an inheritance and estate tax waiver work.

Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply. In 2021 this amount was 15000 and in 2022 this amount is 16000. If the gift or estate includes property the value of the property is.

North Carolina Inheritance Tax and Gift Tax. I the personal representative in the above estate. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

The estate tax is different from the inheritance tax. Get Access to the Largest Online Library of Legal Forms for Any State. Are you looking for Inheritance Tax Waivers.

REV-720 -- Inheritance Tax General Information. Use this form for a decedent who died before 111999. In other words you can make up to 16000-worth gifts to as many people as you wish every year.

North Carolina Department of Revenue. Inheritance taxes are levied on heirs after they have received money from the deceased. When do you need an estate tax.

How Inheritance and Estate Tax Waivers Work. The inheritance tax is no longer imposed after December 31 2015. What is an Inheritance or Estate Tax Waiver Form 0-1.

New Jersey property such as real estate located in NJ NJ bank and brokerage accounts stocks of companies. PO Box 25000 Raleigh NC 27640-0640. However tax release forms are not required to be obtained for assets passing to a surviving spouse alone regardless of the dollar amount.

North Carolina Department of Revenue. Then this is the place where you can find sources which provide detailed information.

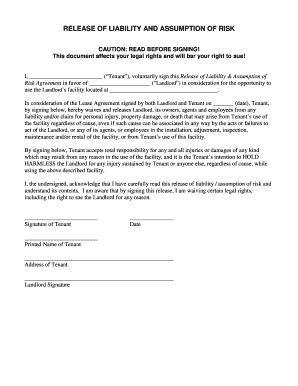

Free Landlord S Waiver Template Faqs Rocket Lawyer

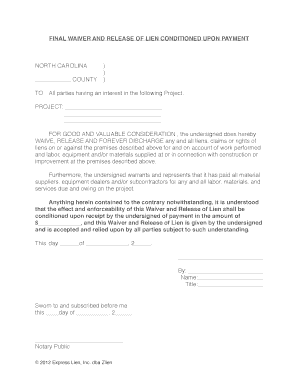

Lien Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Free 10 Sample Waiver Forms In Pdf Ms Word Excel

Free Covid 19 Liability Waiver Template Rocket Lawyer

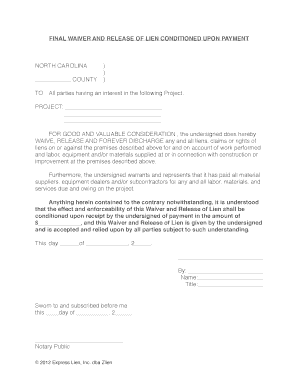

Final Lien Waiver Form Pdf Fill Online Printable Fillable Blank Pdffiller

Rental Waiver And Release Of Liability Form Fill Out And Sign Printable Pdf Template Signnow

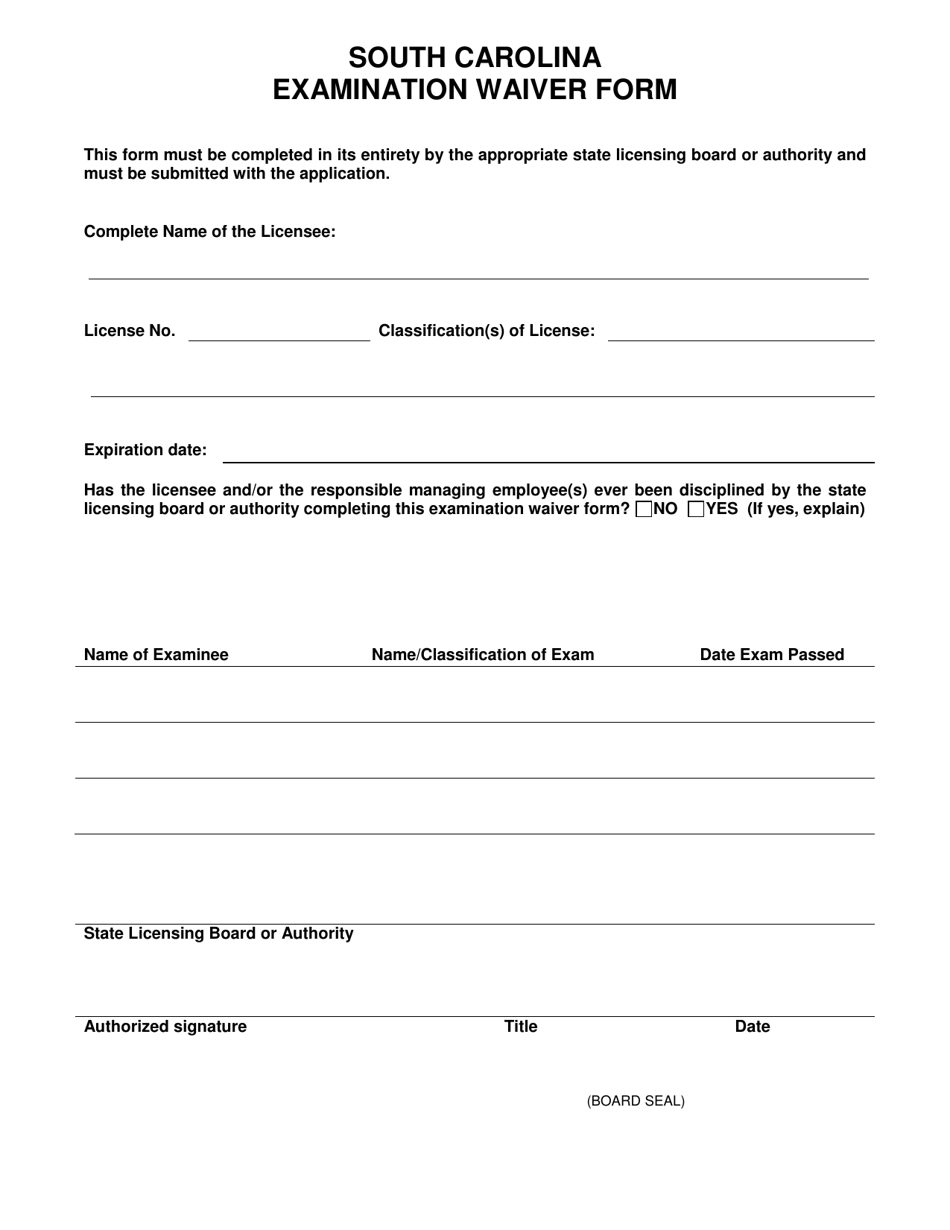

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

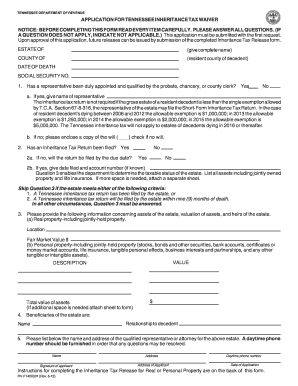

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Blank Lien Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Texas Terms Of Sale Golf Cart And Waiver And Release Of Liability For Purchase Golf Cart Waiver Form Us Legal Forms

Final Lien Waiver Form Pdf Fill Online Printable Fillable Blank Pdffiller

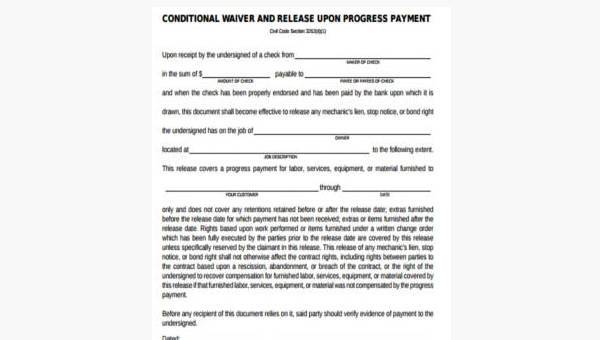

Nc Interim Waiver And Release Upon Payment Fill And Sign Printable Template Online Us Legal Forms

Printable Lien Waiver Form Fill Online Printable Fillable Blank Pdffiller